How does user acquisition funding work?

User acquisition funding is the financing of a company’s growth activities through receivable-backed payouts. (If you are unsure what user acquisition is, you should read this article first before we discuss user acquisition funding.)

User acquisition is something game studios or any apps have to continuously work on even after the initial release of their game or app. Therefore, developers are left with financial challenges to finance paid user acquisition campaigns after spending most of their early funding in the development process. There are various methods of funding that studios can choose from to solve this problem. Recently, among these methods, interest in user acquisition funding has been growing as it allows developers to maintain full control over their game and stay debt-free, while unlocking capital early to scale up their games.

Why is user acquisition funding essential to game studios and app developers?

So why would you need UA funding when your game or app may be faring well and generating revenue?

Although new users may be installing your app every day, there are always existing players or users leaving your game, also known as player churn. Therefore, even if the user retention rate remains at a certain level without falling, if the marketing efforts stay at the same level, your overall game growth will eventually plateau and may even start diminishing. In order to delay your growth from reaching the peak just yet, you have to continue scaling up through paid user acquisition if organic growth is slow.

According to AppsFlyer, user retention is on average 20% higher with non-organic users than with organic users. A small difference in user retention rate could have a significant impact on the lifetime value of the user base as a whole, thus it is crucial for studios to have sufficient marketing budget in hand.

Unfortunately, game studios are constantly faced with liquidity problems due to payout delays of up to 90 days induced by distribution platforms and ad networks. With UA funding, this delay can be removed and studios can receive expedited payout of their accumulated revenue.

UA funds focus on this unique challenge and solve it by providing cash advance for the revenue receivables. This approach is also known as invoice factoring or revenue factoring, because the borrower has to provide an invoice of their revenue to receive an advance payment of it. This naturally makes the transaction low-risk for both the lender and the borrower, as both parties are assured of the borrower’s ability to repay.

By receiving UA funding, developers can focus on game development to fulfil the players’ entertainment needs and to compete in the fast-paced game market, while receiving enough funds to gain non-organic users through paid user acquisition.

How can user acquisition funding accelerate your growth?

In order to outpace competitors in this highly fragmented mobile games market, timely reinvestment in user acquisition is crucial. Without reinvesting, the game or app growth is bound to stagnate. For a game to grow continuously while all things being equal, studios and developers have to either reduce the cost per install or increase the marketing budget. Cost per install (CPI) is calculated by dividing the ad spend over a certain period of time by the number of new installs acquired during that period. So if a studio is not willing to increase the marketing budget, the only way to increase performance is to increase the cost efficiency and the consequent number of installs with the same budget, which is quite a slow and challenging process.

Reinvesting especially when your game is thriving is crucial to attain the full potential of your game and your campaigns. However, even if your game or app is successfully generating revenue, you will not have your hands on this money until much later, due to the aforementioned payout delays from distribution platforms and ad networks. This is where UA funding comes into play. By increasing the marketing budget with your accelerated revenue payout received from UA funds, your game could still achieve linear increase in the number of users, while maintaining constant CPI and retention rates. Sounds exciting? Definitely - but this is not the end. These new users will also be generating more revenue on your game, leading to more money you could claim from your UA fund and reinvest, leading to accelerated growth.

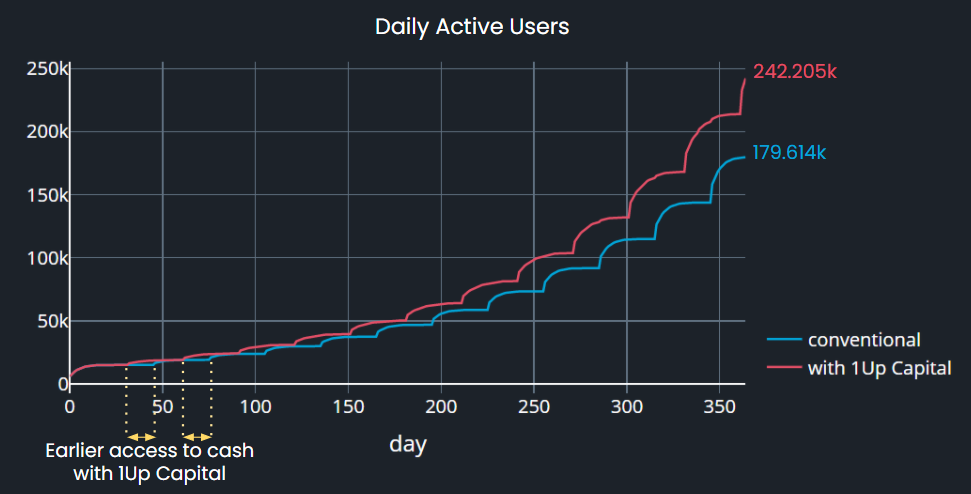

To illustrate, if an Android game developer with a CPI of €0.70 and Average Revenue per Daily Active User (ARPDAU) of €0.25 invests €20,000 and 5% of revenue into marketing, the developer is able to grow the daily active users (DAU) to approximately 179,600 users in one year after release, hypothetically.

All things being equal, if the same developer receives their revenue earlier each month by working with UA funds such as 1Up Capital, they are able to reinvest this revenue earlier in paid UA campaigns, giving them an advantage over the competitors. This way, after a year, the developer is able to grow to 242,200 users, which is 35% greater than what they could have achieved with the payout delay.

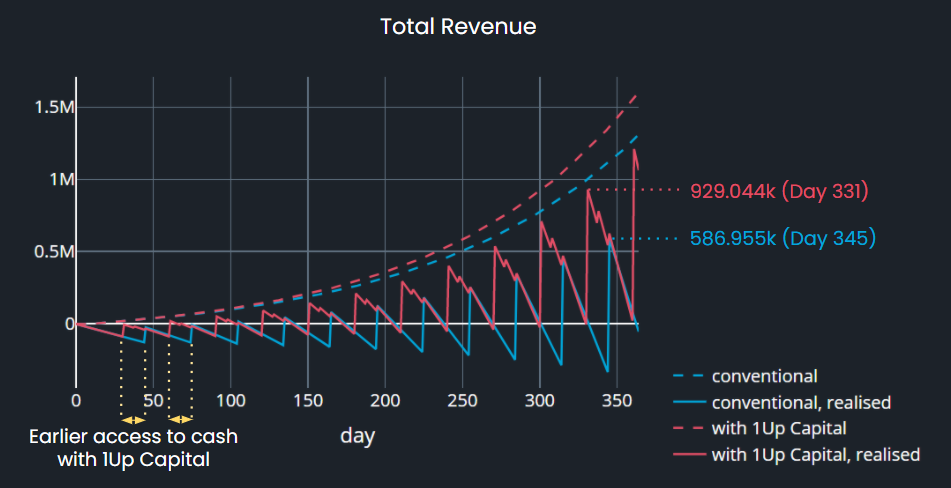

The discrepancy is even greater in terms of revenue. Within a year, the total revenue is 58% greater by the time the developer receives the eleventh month’s revenue, when partnering with a UA fund to receive early payout. The early payout not only helps the developer have their hands on the cash faster, but also allows the game to grow to a greater scale in less time.

Which user acquisition fund should you speak to?

User acquisition funding is rather a new phenomenon in the gaming market, but different UA funds have already developed unique positions in the market with different funding mechanisms. They all offer an alternative to the classical publishing route (read more on publishing vs self publishing here).

Some UA funds offer accelerated payout of accumulated revenue at a fixed rate, regardless of the size of the payment or the performance of the game. Some others offer at a flexible rate on a case-by-case basis.

When providing the advanced earnings, some UA funds do not place limits on how you spend the money, while some would only allow you to use the money to fund user acquisition and marketing activities. The approval time and the minimum or maximum amount of payout also differs by different funds.

Depending on the amount of payment you seek, your game’s KPIs and your studio’s vision, different UA funds may provide the greatest benefits at the lowest cost for you.

At 1Up Capital, we provide UA funding at a flexible rate, determined through our planning meetings and due diligence process. We provide full-transparency on your cash flows through our real-time dashboard and work closely with you to help set up and optimise your user acquisition campaigns. 1Up Capital provides you with an advancement on your accumulated revenue, with no restriction on how you spend your revenue. We also incorporate machine learning algorithms to offer turbocharged payouts for your forecasted revenue.

If you want to learn more about what makes 1Up Capital stand out from other UA funds, get in touch.